Compliance That Moves at Business Speed

Launch in days, not months.

Compliance was not built for the pace of modern finance.

Legacy systems record, flag issues, restrict, and remind. They don't help you move faster. Meanwhile, risk evolves, regulations change, and innovation races ahead but opportunities vanish.

Banks lose deals to faster competitors. Fintechs spend months proving readiness. Everyone drowns in manual work that should be automated.

The bottleneck isn't your people. It's your platform.

Compliance can't slow business. It must enable growth securely, intelligently, and transparently.

Unicore is built by experts who know speed and rigor can coexist for teams who believe compliance shouldn't slow business down.

Compliance should give business confidence to accelerate.

Meet Unicore

Understands & Reinforces

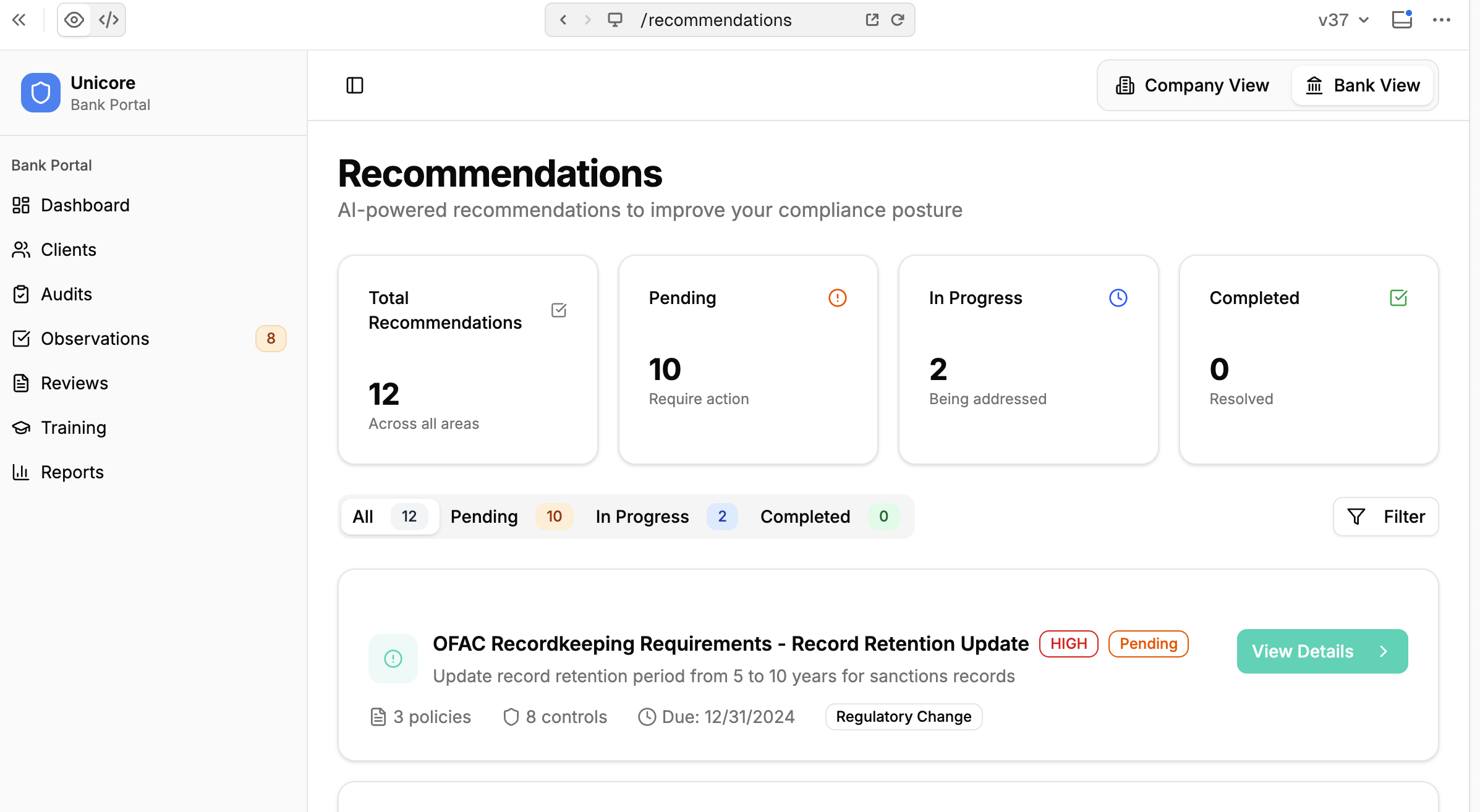

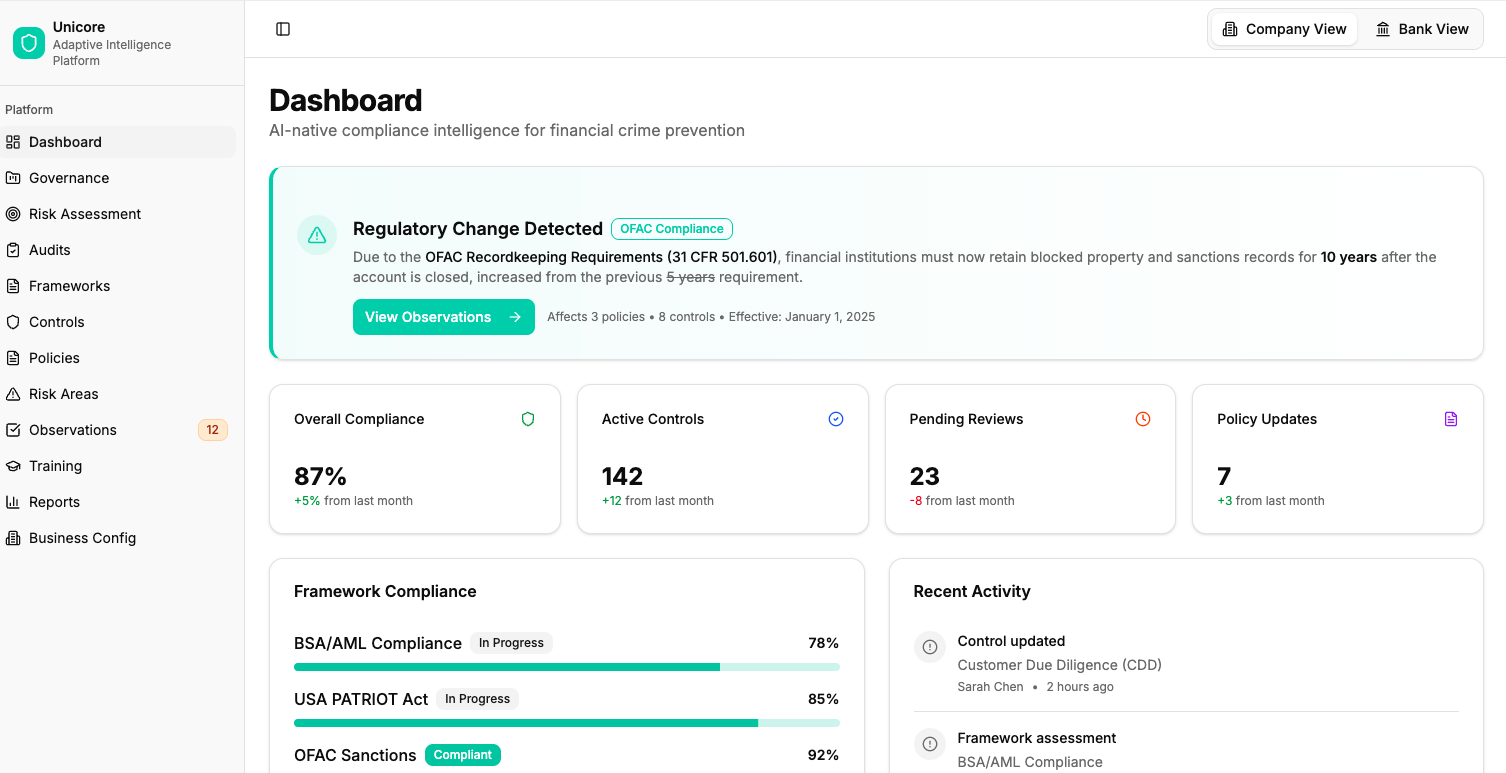

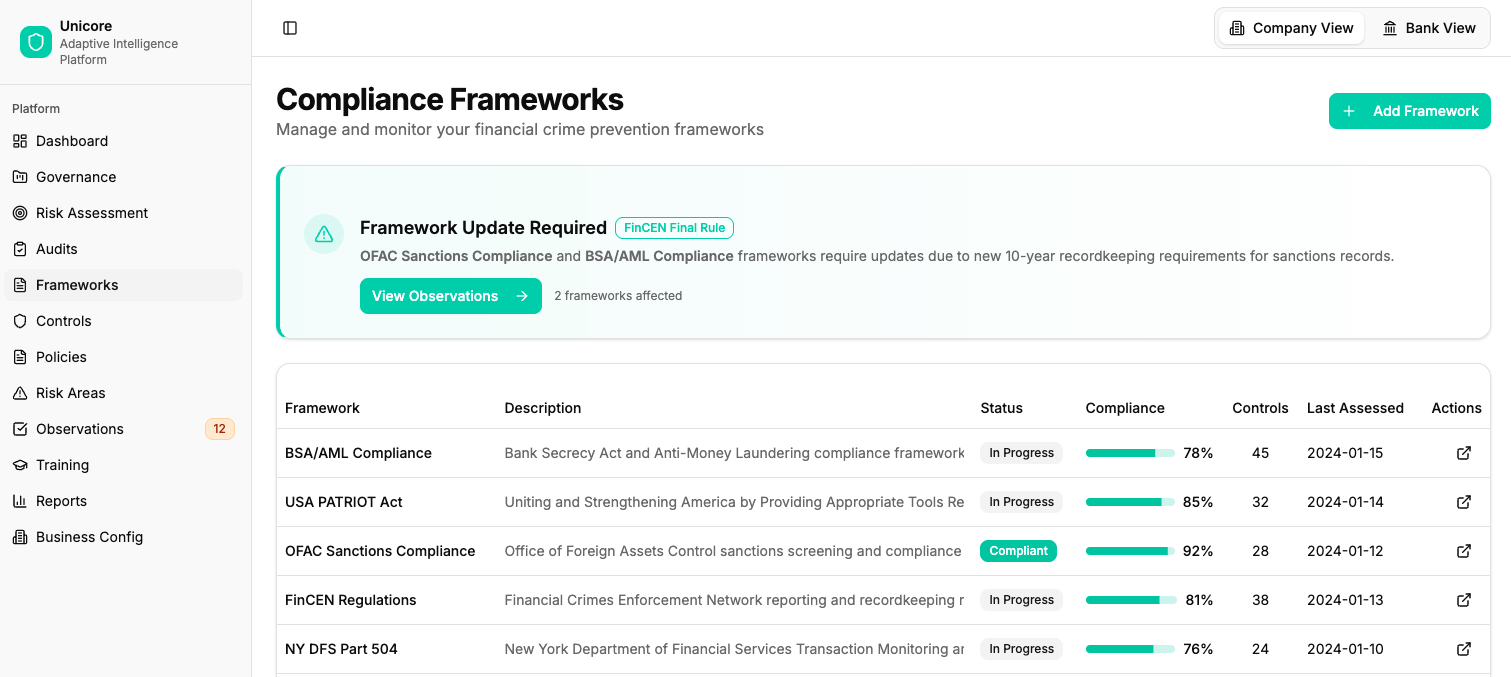

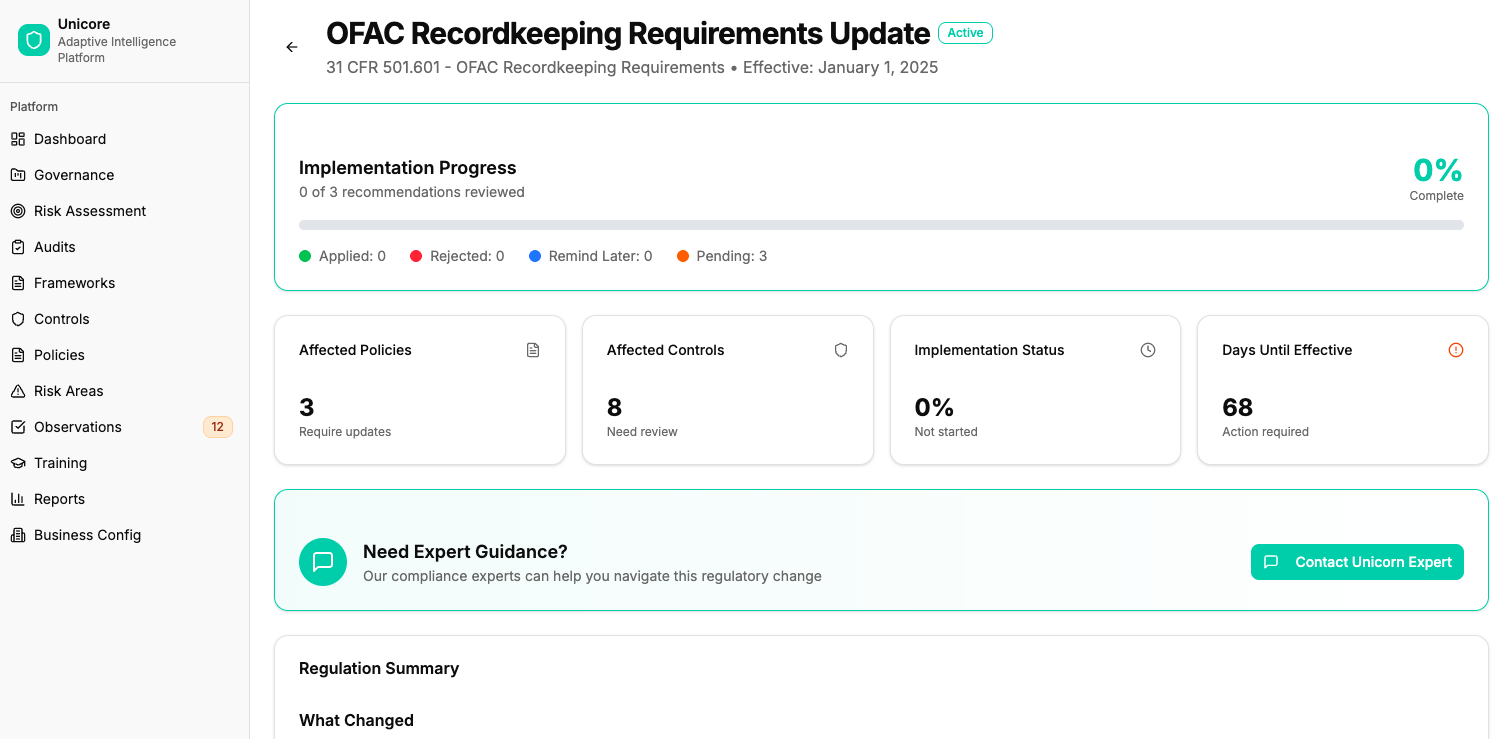

Unicore is the first system that doesn't just track compliance. It understands and reinforces it.

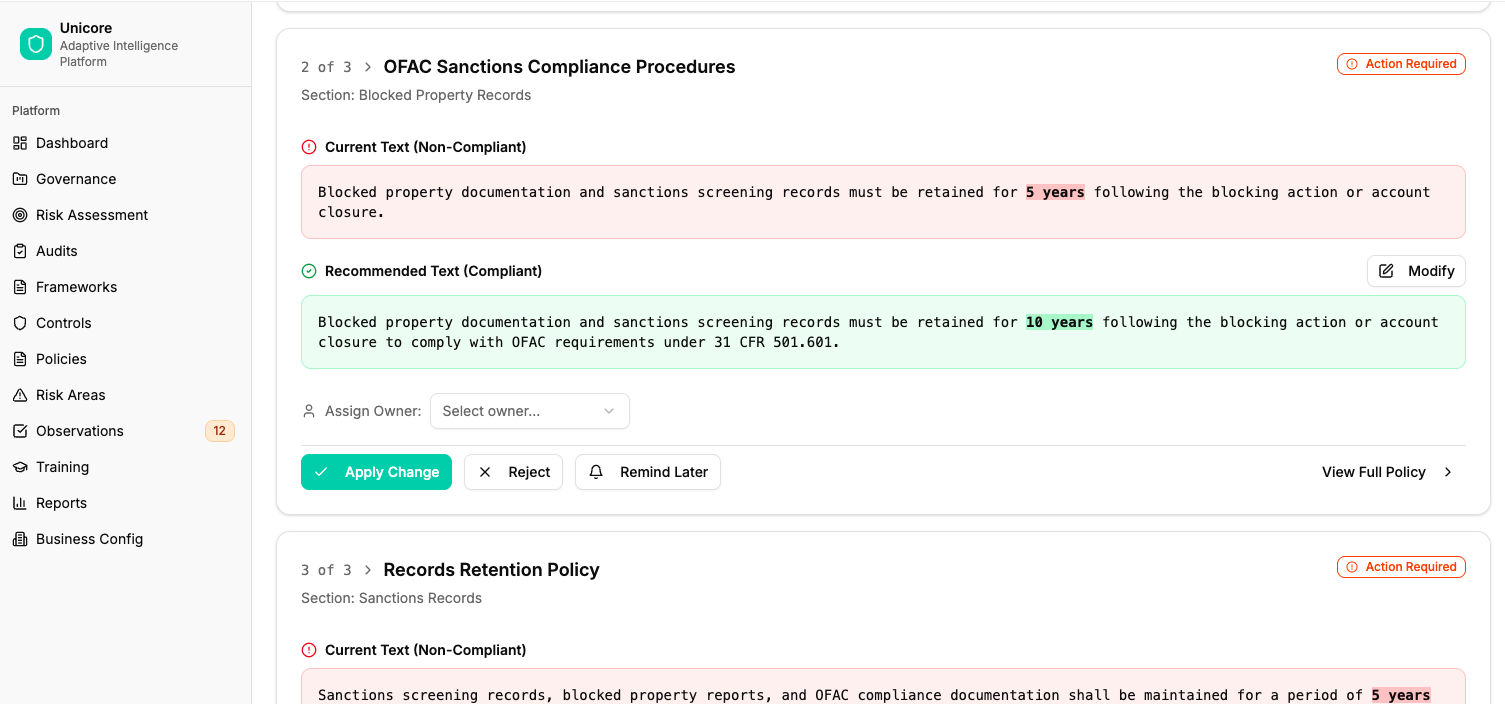

AI + Human Intelligence

Unicore fuses AI efficiency with human expertise to create a living model of your compliance posture that learns, adapts, and explains its reasoning. Outputs, from a redline to a control update, includes clear explanations of why it was proposed and how it was derived for human review and decisioning.

Fully Customizable

Unlike traditional systems, Unicore is fully customizable. Every user can tailor dashboards, workflows, analytics, and interfaces to their role — no engineers, no code, no delay.

Expert Support On-Demand

When deeper judgment or interpretation is needed, Unicore Experts are just a click away to review and advise within hours.

Automation when you want it. Expertise when you need it.

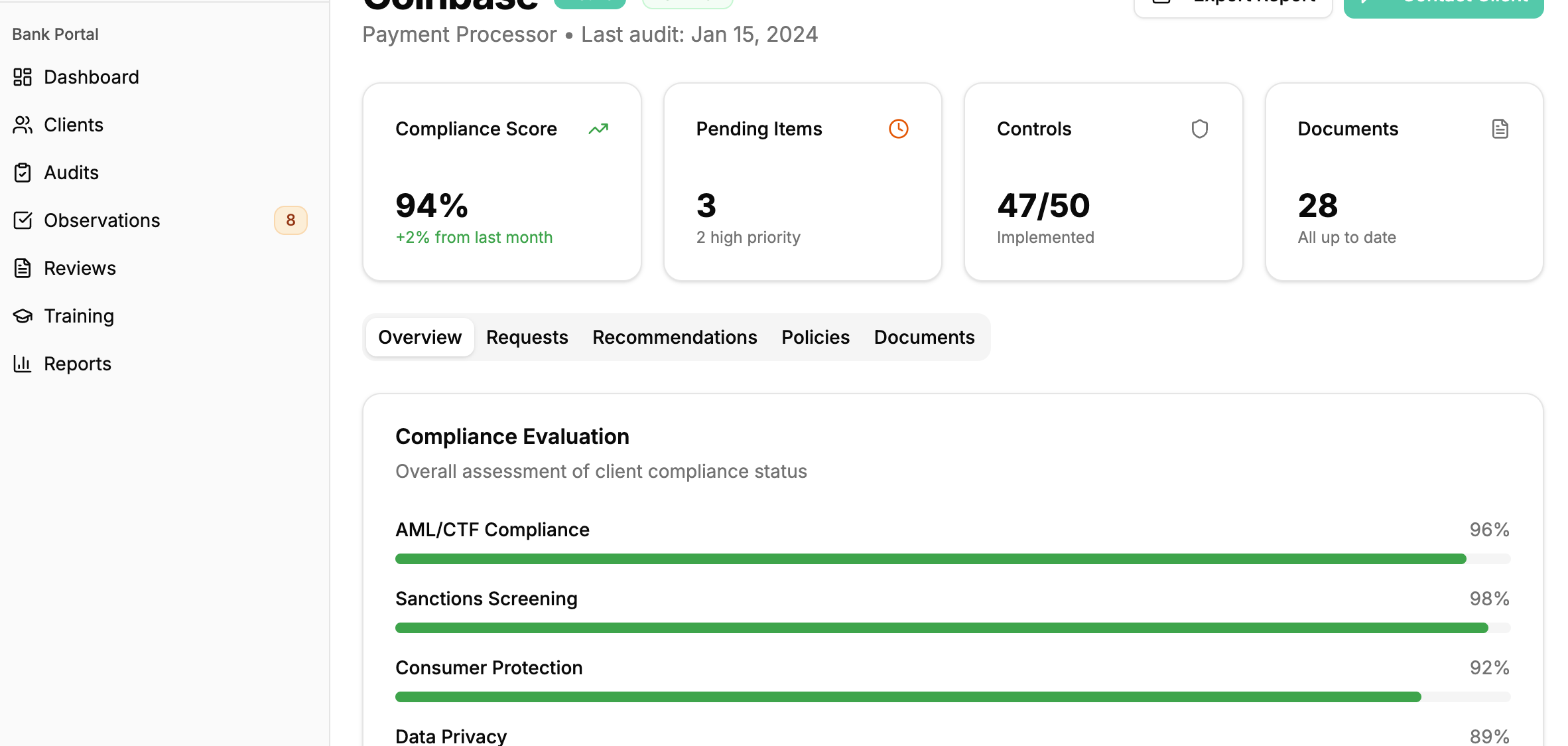

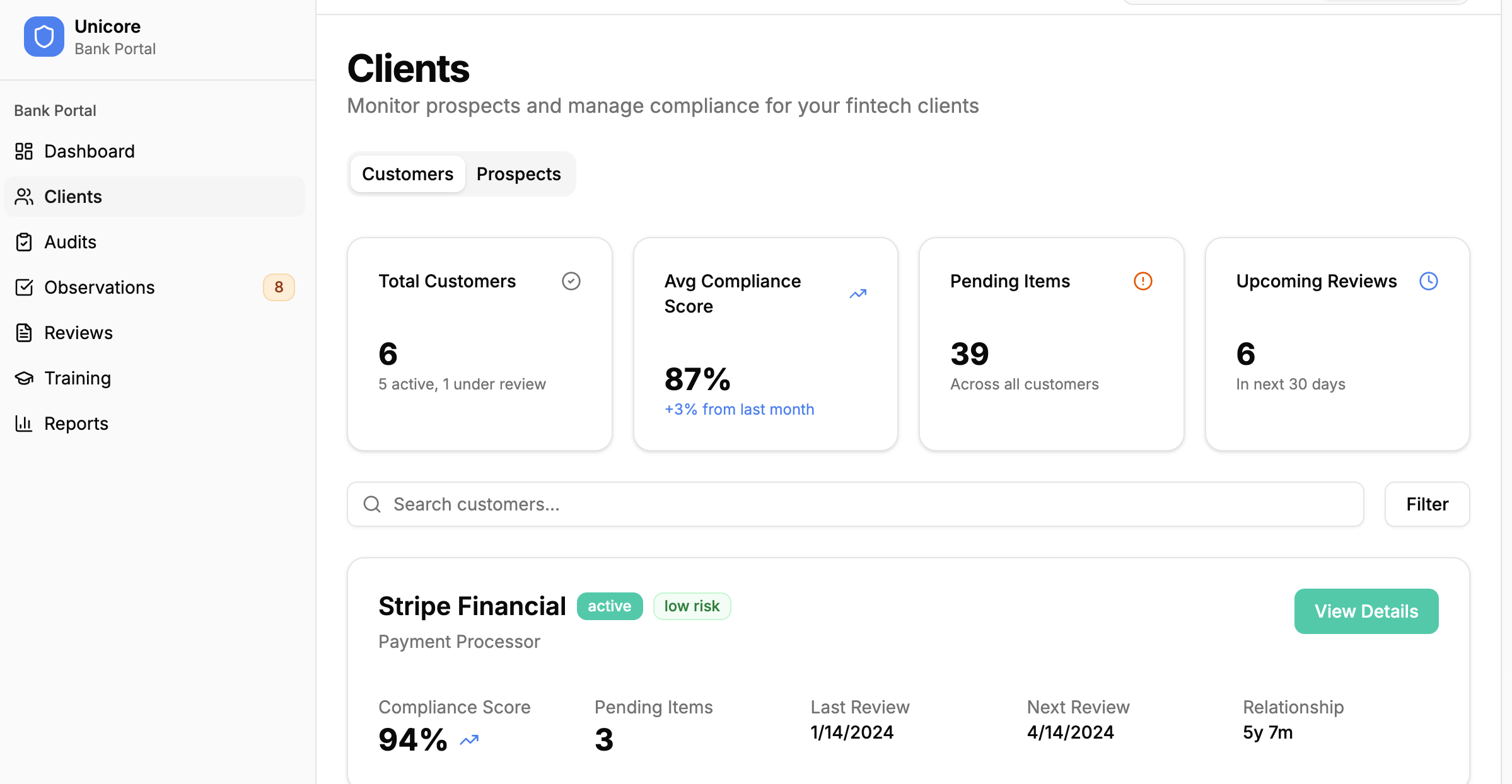

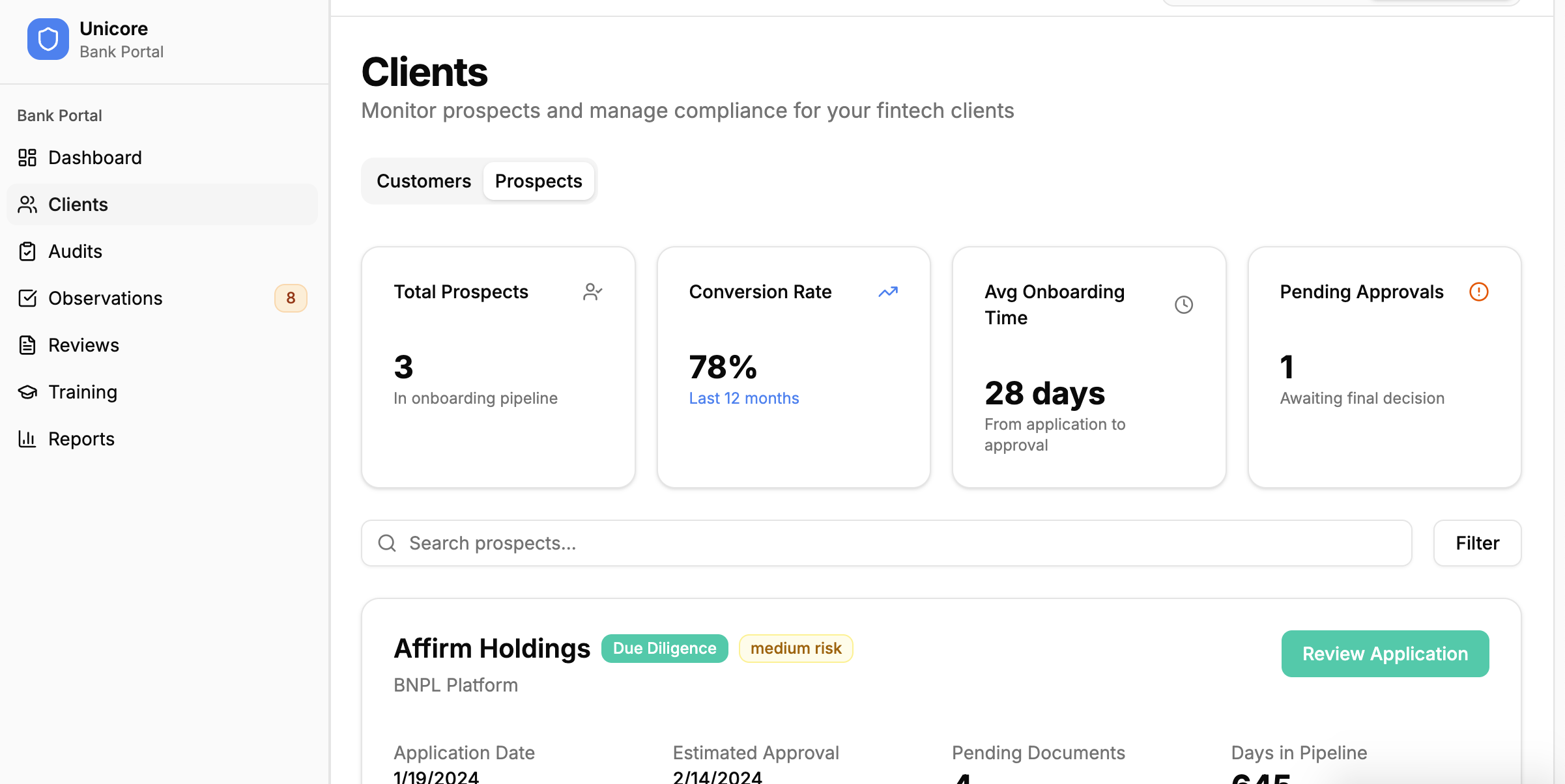

Accelerate onboarding without losing oversight.

See every control, finding, and fix in one view.

When your CCO reports to the board, they're presenting evidence backed by intelligence.

Build bank- and license-ready compliance programs in weeks.

Submit faster. Launch sooner.

Let Unicore develop the groundwork so your team can focus on product and growth.

Spend less time assembling evidence and more time interpreting it.

Unicore automates the mechanical work, freeing you to provide strategic value.

Scale your expertise, not your workload.

Works With Your GRC System

Adding adaptive intelligence that validates, redlines, and remediates automatically, with transparent reasoning and optional verification by Unicore Experts.

Transform record-keeping into explainable assurance.

Faster, Cheaper, Better

| Process | Legacy | Unicore | Impact |

|---|---|---|---|

| Bank partnership onboarding | 12-16 weeks | 5-10 days | 12x faster revenue |

| License application | 4-6 months, $250K-$500K | 2-4 weeks, $50K | 80% lower costs |

| Remediation cycles | 4-6 weeks | 3-5 days | Audit ready |

| Platform configuration | 3-6 months | Minutes | Ready day 1 |

Why Unicore Is Different

Unicore combines machine intelligence with human judgment.

| Legacy GRC | Unicore |

|---|---|

| Static templates | Adaptive, self-optimizing |

| Manual oversight | Continuous, explainable assurance with expert integration |

| IT-heavy customization | Fully configurable, no code required |

| No or minimal AI automation | Purpose-built AI that is transparent and audit-ready |

| Reactive compliance | Proactive risk management |

Built for Regulators. Trusted by Banks.

Financial services have zero tolerance for security risks or unexplainable decisions. We built Unicore accordingly.

Explainable by Design

Unicore recommendations include:

- The regulations it addresses

- The reasoning behind the recommendation

- References to source documents

- Confidence scores

- Audit trail

When examiners ask for explanations, you have a documented answer.

Secure by Architecture

- Zero-trust design: Actions authenticated and authorized

- End-to-end encryption: Data protected in transit and at rest

- Private AI models: Your data trains only your instance, never shared

- Dedicated environments: Data isolation for each entity

- SOC 2 Type II and ISO 27001-aligned infrastructure

Your compliance intelligence stays yours—secure, private, and explainable.

Always Human in the Loop

- AI develops

- Humans evaluate

- Nothing goes live without your review

Automation for speed. Human judgment for trust.

Compliance That Accelerates Growth

The Institutions That Win the Next Decade Won't Be the Biggest or Oldest

Speed wins markets. Transparency wins trust. Unicore delivers both.

We built Unicore because talented people shouldn't waste their lives on manual work that machines can do better.

Policy updates, control testing, risk monitoring, gap analysis, and documentation don't require human creativity and reasoning, they require precision, consistency, and tireless attention.

Humans should focus on judgment, strategy, and relationships. Machines should handle everything else.

Secure Your Spot for Early Access

Join leading institutions to shape the next evolution in compliance intelligence and receive launch updates and early access details.